The Dual Aspects of Value Creation

Value creation is a reciprocal process. It is through creating sustainable value for our stakeholders that we are able to create value for our business. Each year, we identify material aspects that may be of mutual interest or concern. This is exemplified in the materiality matrix that was discussed previously.

Capital Formation

The process of value creation then leads to the establishment of capital. Capital stores value, and in the milieu of integrated reporting, references the resources and relationships that influence our operations.

Capital that is owned by the business is termed ‘internal’ and that which falls outside of this domain is titled ‘external’. The business has holistic access to and utilises all relevant capitals to create sustainable and reciprocal value.

Internal capital consists of financial and institutional capital. Financial capital is discussed in the Financial Statements. Institutional capital comprises intangible assets such as integrity, trust and brand image.

External forms of capital focus on key stakeholders. They are sub-divided as investor, customer, business partner, employee and social and environmental capitals.

An Integrated View of Our Business Model

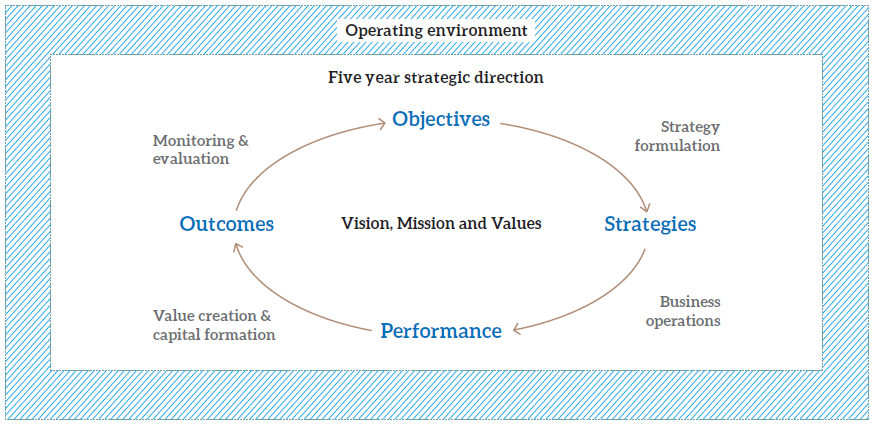

The diagram above is a visual representation of the key components of our business model.

SLT’s corporate vision and mission, as detailed in the inner cover, underpins all our operations. These are developed through strategic operations, which explain the objectives we seek to fulfil in the short, medium and long-term. These objectives are consequently transformed into plans of action, which are detailed accordingly.

SLT’s strategies are effectuated through its operations; the results of which are measured through key performance indicators (KPIs). KPIs are influenced by time-frames. A more detailed view of our business is exemplified through the outcomes of value creation and capital formation. Both of these aspects are comprehensively discussed in the Management Discussion and Analysis section appears in this Annual Report.

The creation of value is equally dependent on the close observance and evaluation of systems at several levels. These activities include corporate governance, risk management and operating environment. The results of these activities influence the further refinement of our overall objectives.

Management Approach

The Management Discussion and Analysis section that follows, details the reasons for which an aspect is identified as being ‘material’, the subsequent actions undertaken to govern them, and the resulting analysis of our performance and outcomes. The discussion is to be laid out along the lines of value creation and capital formation, and is appropriately backed by key performance indicators and related measures.