Value Creation and Capital Formation

The dual aspects of value creation

Value creation is a reciprocal process. It is through creating sustainable value for our stakeholders that we are able to create value for our business. Each year, we identify material aspects that may be of mutual interest or concern. This is exemplified in the materiality matrix that was discussed previously.

Capital formation

The process of value creation then leads to the establishment of capital. Capital stores value, and in the milieu of integrated reporting, references the resources and relationships that influence our operations. Capital that is owned by the business is termed “internal” and that which falls outside of this domain is titled “external”. The business has holistic access to and utilises all relevant capitals to create sustainable and reciprocal value. Internal capital consists of financial and institutional capitals. Financial capital is discussed in the financial statements. Institutional capital comprises intangible assets such as integrity, trust, and brand image. External forms of capital focus on key stakeholders. They are subdivided as investor, customer, business partner, employee, and social and environmental capitals.

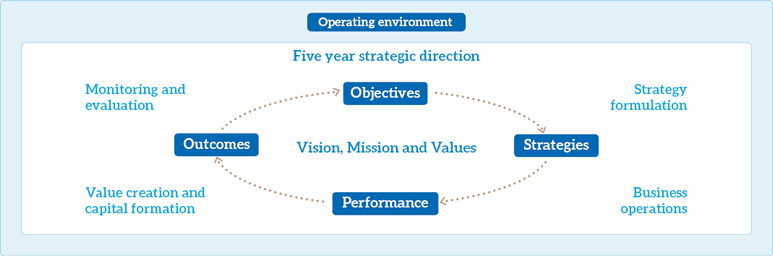

An integrated view of our business model

The diagram below is a visual representation of the key components of our business model. SLT’s corporate vision and mission, as detailed in the inner cover, underpins all our operations. These are developed through strategic operations (page 22), which explain the objectives we seek to fulfil in the short, medium, and long-terms. These objectives are consequently transformed into plans of action, which are detailed on pages 22 to 27 SLT’s strategies are effectuated through its operations; the results of which are measured through key performance indicators (KPIs). KPIs are influenced by time-frames. A more detailed view of our business is exemplified through the outcomes of value creation and capital formation. Both of these aspects are comprehensively discussed in the Management Discussion and Analysis section commencing from page 32.

The creation of value is equally dependent on the close observance and evaluation of systems at several levels. These activities include Corporate Governance (pages 96 to 107), Risk Management (pages 110 to 114), and Operating Environment (pages 20 to 21). The results of these activities influence the further refinement of our overall objectives.

Management approach

The Management Discussion and Analysis section that follows, details the reasons for which an aspect is identified as being “material”, the subsequent actions undertaken to govern them, and the resulting analysis of our performance and outcomes. The discussion is to be laid out along the lines of value creation and capital formation, and is appropriately backed by key performance indicators and related measures.